A higher EPS generally indicates a higher value and profits relative to a company’s stock price, though there’s no number set as a “good” EPS. Instead, consider EPS trends over time and how a company’s EPS compares to that of its peers. EPS can be used to make investment decisions by comparing it to the EPS of other companies in the same industry. This can help investors determine which companies are more profitable and may be a better investment option.

What is the Earnings per Share (EPS) ratio used for?

Because they are generally entitled to a certain dividend and are reimbursed in the event of a company’s collapse, preferred stockholders have less risk than common stockholders. This implies that before common shareholders can claim the assets in a company, bondholders, preferred shareholders, employees, and creditors must be repaid completely. The risk of holding common stock in a business is that the general shareholders are the last to be reimbursed or to claim the company’s assets if it goes bankrupt. Some shares may be acquired by public members, whereas others are only available to certain people in the company. In the following sections, we will look at the sorts of stock and earnings per share companies offer. Before earnings reports come out, stock analysts issue earnings estimates (an estimate of the number they think earnings will hit).

Create a Free Account and Ask Any Financial Question

Basic earnings per share are recorded in a company’s income statement and are quite important for assessing the performance of firms with just common shares. While EPS is an important measure of profitability, it has limitations, including an overemphasis on short-term profits, potential for manipulation, and failure to reflect cash flow or account for size bias. Therefore, it’s essential for investors to understand these limitations when making investment decisions. On the other hand, diluted EPS considers the dilutive effects of potential shares that could be issued, like stock options or convertible securities. The formula is the same, but the denominator includes these potential shares.

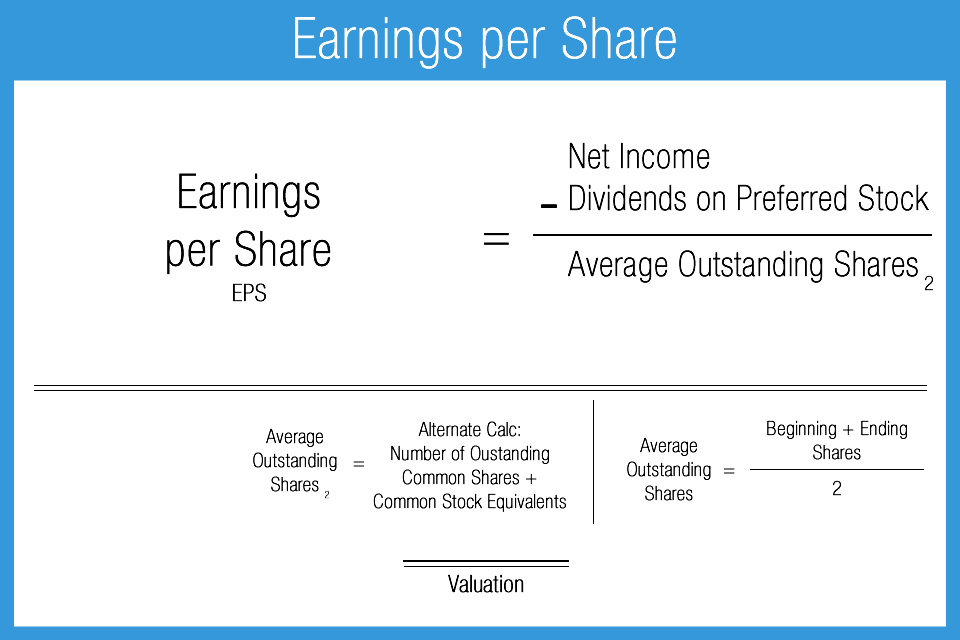

EPS formula and example

A lower P/E ratio might indicate that the stock is undervalued, making it a potential investment opportunity. Earnings Per Share is a critical measure of a company’s profitability, but it should not be used in isolation. Other financial ratios provide complementary insights, contributing to a more holistic view of a company’s financial health. Changes in the number of a company’s outstanding shares can impact EPS. When a company issues more shares (without a proportionate increase in net income), EPS can decrease because earnings are spread over a larger number of shares. Earnings Per Share (EPS) is a vital financial metric for investors as it provides direct insight into a company’s profitability.

) Reported Earnings Per Share

- For both basic EPS and diluted EPS, the earnings figure should be the same.

- Preferred dividends are set-aside for the preferred shareholders and can’t belong to the common shareholders.

- It is used to draw conclusions about a company’s earnings stability over time, its financial strength, and its potential performance.

Understanding EPS is a step in fundamental analysis — but only a step. First, the exercise price of the options or warrants may be above the trading price. In that case, the shares underlying the options are excluded because, at the moment, they are not going to be exercised. While EPS is a widely used and essential tool, it has several limitations and can be easily misinterpreted.

Earnings per share, or EPS, is a ratio that divides a company’s earnings by the number of shares outstanding to evaluate profitability and gain a pulse of the company’s financial health. This number changes often, so investors sometimes use the weighted average of the shares outstanding to determine the EPS for a specific time period. EPS, or earnings per share, is a financial figure studied by investors, traders, and analysts. It is used to draw conclusions about a company’s earnings stability over time, its financial strength, and its potential performance. For example, they may compare the forward EPS (that uses projections) with the company’s actual EPS for the current quarter. If the actual EPS falls short of forward EPS projections, the stock price may fall as investors register their disappointment.

Negative EPS typically isn’t good news — but on its own, it doesn’t necessarily mean a stock is uninvestable, or even too expensive. A company with negative earnings per share is not necessarily a company with little or no value. Why the EPS is negative usually is more important than by how much it’s negative. The core reason is that share counts can be extraordinarily different. A company that earns $3 per share, and has 1 billion shares outstanding, generates far more profit ($3 billion) than a company that earns $30 per share and has only 1 million shares outstanding ($30 million). Both metrics can be used to understand the fair value of a stock — but from very different perspectives.

Earnings per share is also important to dividend investors, growth investors and speculators. To get a more accurate projection of earnings on a per share taxhow » schedule m basis, both Net Income and Common Stock are often adjusted by investors. You’ll find this figure at the bottom of a company’s income statement.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. When a company has enough profit to pay shareholders but chooses not to, Retained earnings per share is the amount of money that would have gone to shareholders. The earnings per shareholder would depend on how much profit the company allots to common shareholders, ranging from USD. As the name suggests, convertible preferred shares can be transformed into common shares if the shareholder desires. Shareholders of participating preferred shares receive dividends that match the specified rate of regular preferred dividends and an additional sum based on a pre-existing condition. Preferred shares are classified into cumulative preferred, non-cumulative, participating preferred, and convertible preferred stocks.