It’s better to have as big a cushion as possible between you and unprofitability. There are only two variables — the market value of a stock and the intrinsic value. Dividing the market value by the intrinsic value then subtracting the result from one equals the margin of safety. It’s difficult to say if there’s an ideal margin of safety for any particular investor.

Margin of Safety Formula

Learn how to analyze your business’s financial health by understanding margin of safety, break-even point, total sales revenue, variable costs, and contribution margin. Perfect for entrepreneurs and business owners.In the world of business, understanding and effectively utilizing financial concepts can make a significant difference in the success of a company. One crucial concept that every business owner should be familiar with is the margin of safety.

How is the margin of safety calculated?

You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering.

What is Safety Stock?

Safety stock is a larger amount of inventory that is a buffer against unexpected events or demand changes. It’s a safety net to ensure there’s enough stock even if there’s a production delay or unexpected demand surge. For example, if you sell high-demand products with demand variability, the signal stock will be the amount of that product you will have on hand (let’s say 500 pieces) to signal when to reorder.

- So, even I usually look at safety stocks as a “necessary evil” because companies usually use them to cover problems inside their own processes or supplier’s processes.

- Investors can make more confident and well-informed decisions about their investments if they consider the asset’s true value and the price a buyer is willing to pay.

- Conversely, this also means that the first 750 units produced and sold during the year go to paying for fixed and variable costs.

- If the intrinsic value exceeds the actual share price, that will constitute a value investment.

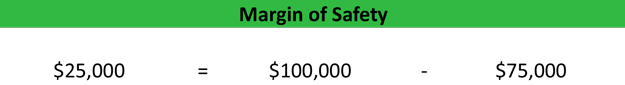

The difference between intrinsic value and the current stock price is the margin of safety. The margin of safety is the difference between a company’s intrinsic value (its estimated 10-year cash flow minus inflation) and the current stock price. If the intrinsic value is $100 and the stock price is $80, the margin of safety is 25%. Businesses can improve their margin of safety in dollars by reducing fixed costs, increasing selling prices, diversifying product lines, and expanding customer base. These strategies can help in creating a larger cushion against uncertainties.

It is because investors can establish a margin of safety based on their personal risk preferences. Additionally, Warren Buffett bases his Intrinsic Value calculations on future free cash flows. He believes cash is a company’s most valuable asset, so he projects how much future cash a business will generate. If a stock price is significantly below a company’s actual fair value, that percentage difference is known as the Margin of Safety. Essentially, it is the percentage by which the stock market undervalues a company. Now you’re freed from all the important, but mundane, bookkeeping jobs, you can apply your time and energy to deeper thinking.

However, these models will require working on improvements and decreasing variability in factors that impact the safety stock that we talk about here. The most simple and basic formula that can be used to calculate safety stock comes from our simple goal to have a secure amount of days of supplies. So, we need first to calculate how many safety days we need and multiply it with the average daily demand. Generally speaking, the higher your margin of safety, the safer your company. The value represented by your margin of safety is your buffer against becoming unprofitable.

The result you will get is the most economical or optimal order quantity that will have the lowest ordering costs and storage costs. If you are a company that produces shoes for sale and you purchase the sole of the shoes according to specifications, you send them to your supplier. So, you can never be sure of how long the delivery will take after you place an order. It’s a signal for replenishment and helps you avoid stockouts without having too much buffer stock. This is particularly relevant in industries with fluctuating sales patterns, like electronics or seasonal products, where customer satisfaction is critical.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for a $10,000 obamacare penalty doubtful convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Seasonal goods, for example, may need to keep any eye on this margin to guide them through off-peak sales periods. Another problem with the margin of safety is that it often uses data from the past, which may not be a good indicator of how an asset will do in the future. It can lead to wrong estimates of an asset’s true value and investments that don’t work out how people thought they would. A third benefit of a margin of safety is that it can lead to higher returns in the long run. By putting money into assets with a large margin of safety, investors can make more money as the asset’s value goes up and the margin of safety goes down. The margin of safety is useful for investors because it shows how likely an investment is to make money and how much risk it comes with.

A product or service with high demand variability will require a larger safety stock to ensure you can meet customer demand during periods of high sales. Safety stock is a buffer that absorbs the demand and supply variability so your business can keep running smoothly. If you have safety stock, you ensure your production lines keep running, your shelves stay stocked, and your services are uninterrupted. Safety stock is the buffer in your inventory management strategy that accounts for the unknowns in your supply chain. Think of safety stock as your insurance policy for when things go wrong, whether it’s demand fluctuations, supplier delays, or unexpected events. Today, keeping the right level of safety stock is key to good inventory management and customer satisfaction.