Undoubtedly, though the market maker’s position Automated Market Maker is kind of complex in technical aspects, it has real value for the financial markets and exchanges. Market makers have always been some of the important components of any monetary market, though we usually do not take into consideration the significance of their liquidity operate. These members must keep fair costs for different property at any time and ensure that demand is roofed. You can create totally different pools to help various token pairs or trading strategies, which helps in managing how tokens are traded and how rewards are distributed to liquidity suppliers.

Understanding Digital Automated Market Makers (vamms)

Instead of a traditional market of producers and customers, automated market makers (AMMs) employ liquidity pools to permit digital belongings to be transferred without consent and mechanically. On a conventional trading platform, patrons and sellers suggest a quantity of prices for an asset. When other users find a listed worth acceptable, they trade it, and that worth turns into the asset’s market worth. Stocks, gold, actual estate, and quite so much of other assets are traded utilizing this traditional market construction.

The Idea Of Market Makers In India

- Virtual Automated Market Makers (vAMM) is a brand new sort of AMM that builds on this foundation and expands its application from token swaps to perpetual contracts.

- A third benefit could be the ability to trade after common market hours, if this is necessary to you.

- For example, GSCO absorbing shares on the inside bid would trigger traders to step in front and cause costs to rise.

- The market makers are recognized to offer two-way quotes with both the shopping for and the selling price, allowing traders to know how much they must pay to purchase a selected amount of shares.

The inventory exchanges concern that if a inventory is very illiquid, it won’t see volatility and will not change in worth continually. If a inventory just isn’t risky at all, it will not see any demand from traders and traders, leaving the current shareholders without any sellers. Liquidity refers back to the concept that traders can simply discover buyers or sellers of stocks with out having to wait for a protracted time. The market makers are recognized to offer two-way quotes with each the shopping for and the promoting worth, permitting traders to know the way much they will have to pay to buy a selected amount of shares.

A Comprehensive Guide On Automated Market Makers

The liquidity pool, which is the gathering of the digital belongings provided by the purchasers, offers the belongings for the commerce. Automated market makers (AMMs) are part of the decentralized finance (DeFi) ecosystem. They allow digital property to be traded in a permissionless and computerized means by utilizing liquidity swimming pools somewhat than a regular market of patrons and sellers.

Major Automated Market Makers

You can efile income tax return in your revenue from wage, home property, capital features, enterprise & occupation and revenue from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, declare HRA, check refund status and generate hire receipts for Income Tax Filing. TokyoTechie is extraordinarily dedicated in market making for utility tokens and cryptocurrencies.

Find Out About Automated Market Makers Within The Crypto Business

A centralized change oversees the operations of merchants and provides an automated system that ensures buying and selling orders are matched accordingly. An automated market maker (AMM) is the underlying protocol that powers all decentralized exchanges (DEXs). Simply put, they’re autonomous buying and selling mechanisms that remove the necessity for centralized exchanges and associated market-making strategies. By incorporating a number of dynamic variables into its algorithm, it could create a more sturdy market maker that adapts to altering market conditions. Their costs are the ones displayed on the Stock Exchange Automated Quotation system and it is they who generally take care of brokers buying or promoting inventory on behalf of shoppers.

Algorithmically Determined Trade Costs

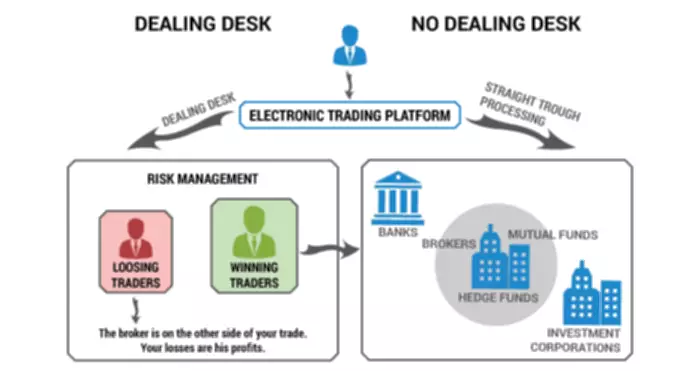

Bear in thoughts that the market model of your broker is just one factor among many that should influence your selection. You’ll want to check out the account varieties available on various brokers earlier than selecting one that suits you. Trusted authorities are monitoring the dealer to ensure everything they do is above board. Market Makers are additionally able to execute trades pretty rapidly, particularly in the event that they use low latency servers. To begin with, a Market Maker is ready to offer its merchandise at a reduction due to having purchased them in such massive amounts.

Understanding Order Handling In Indian Stock Markets – A…

The market makers should follow the same to operate as an authorized buying and selling body. In the United States, the Securities and Exchange Commission approves and takes care of the legal views of the financial markets. For example, a market maker could also be prepared to buy your shares of XYZ from you for $100 each—this is the bid value. Did you understand that stock exchanges attempt to enhance liquidity and trading volume at times? Stock exchanges rely upon market makers to ensure a continuous move of shares to buyers. Without their presence, we might not have access to shares, derivatives, and other securities always.

Their function is to provide liquidity to the markets and facilitate commerce, not to manipulate costs or interact in different types of market abuse. The Bombay Stock Exchange (BSE), the National Stock Exchange (NSE), and many different players have employed them to improve liquidity. Market makers themselves hold securities to facilitate the actions in the stock market . Since the worth of securities may go down any time, these makers are in danger.

As we’ve seen via this weblog submit, market what is market maker in crypto makers are able to leverage their place within the trading network to generate vital revenues. With a rising variety of participants entering the stock market, the longer term prospect for market-making corporations is brilliant. They research the shares and the prices at which they are being traded out there. Oftentimes, the optimum route can embody many hops and sophisticated splitting, making it a particularly onerous downside to unravel.

For instance, a wallet developer can add their own zero.1% on prime of the zero.2% network fee and maintain the distinction. Market makers ensure liquidity by constantly quoting bids and asking costs for securities, allowing patrons and sellers to simply discover counterparties for their trades. Building a decentralized buying and selling platform that includes sensible contracts and monetary incentives is the aim of AMM DEX Development Solution.

Read more about https://www.xcritical.in/ here.